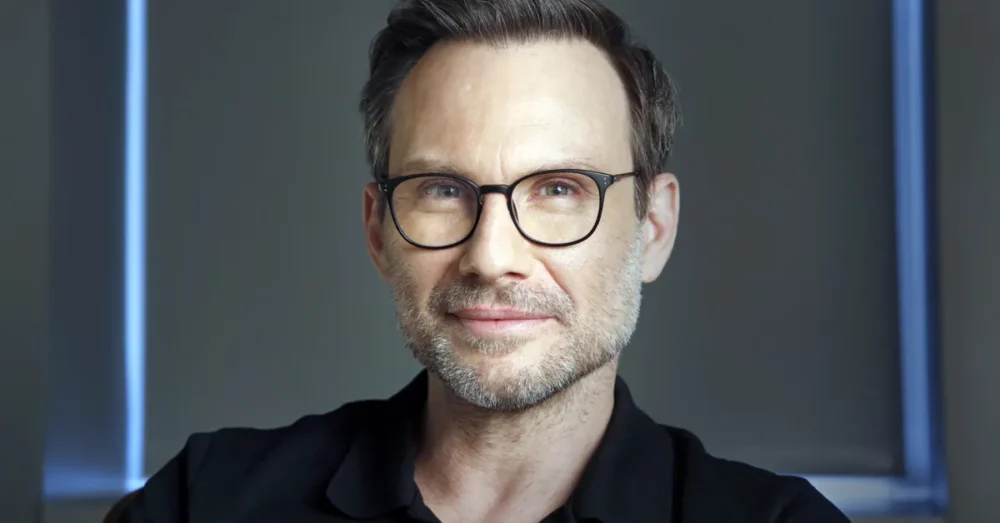

Dave Ramsey’s Net Worth and Biography in a Nutshell

- Net Worth: $200 Million

- Birthdate: September 3, 1960 (64 years old)

- Birthplace: Antioch, Tennessee, USA

- Gender: Male

- Profession: Motivational Speaker, Author, Radio Personality, Financial Adviser

- Nationality: United States of America

What is Dave Ramsey’s Net Worth in 2024?

Dave Ramsey, a well-known American financial expert, author, and entrepreneur, has an impressive net worth of $200 million. A significant portion of his wealth, about $150 million, comes from his extensive real estate portfolio.

What Makes Dave Ramsey Famous?

Dave Ramsey is best recognized for building a business that helps people master personal finance. His financial advice is rooted in his personal experiences and often includes a Christian perspective, making his teachings relatable and actionable for a wide audience.

The Ramsey Show: A National Success

Dave Ramsey hosts “The Ramsey Show,” a nationally syndicated radio program that airs on over 500 radio stations across the U.S. and Canada. The show is a go-to resource for listeners looking for practical financial advice, tips on getting out of debt, and insights into wealth-building strategies.

Best-Selling Author of Financial Books

Ramsey has authored several popular finance books, including the highly acclaimed “The Total Money Makeover.” His books simplify complex financial concepts and offer actionable steps to help individuals achieve financial freedom.

Why Follow Dave Ramsey?

Dave Ramsey’s unique approach to money management resonates with millions. Whether you’re looking to pay off debt, grow wealth, or learn about smart investing, his advice is trusted and time-tested.

By following his teachings, many have transformed their financial lives, proving that with the right knowledge and discipline, financial freedom is within reach.

Early Life and Education of Dave Ramsey

Humble Beginnings in Tennessee

Dave Ramsey was born on September 3, 1960, in Antioch, Tennessee, to parents who worked in real estate development. Growing up in this environment, Dave gained early exposure to the world of business and finance.

High School Years

During his teenage years, Ramsey attended Antioch High School, where he balanced academics with extracurricular activities. He was also a member of the school’s ice hockey team, showcasing his determination and teamwork skills from an early age.

College and Career Beginnings

Ramsey pursued higher education at the University of Tennessee in Knoxville, where he studied finance and real estate. While still a student, he began selling properties, marking the start of his career in the real estate industry.

This combination of formal education and hands-on experience laid the foundation for Ramsey’s future success as a financial expert and entrepreneur.

Career Beginnings

Early Success in Real Estate

By 1986, Dave Ramsey had achieved remarkable success, amassing a real estate portfolio worth over $4 million. However, his fortunes took a sharp downturn in 1987 when the Competitive Equality Banking Act led to the recall of his $1.2 million in loans and credit lines. Unable to meet his financial obligations, Ramsey was forced to file for bankruptcy in 1988.

A Journey of Recovery

After experiencing financial collapse, Ramsey embarked on a journey of recovery. Drawing on his own experiences, he began sharing financial advice with couples at his local church. This grassroots effort to help others manage money marked the beginning of his career as a financial advisor.

Founding the Lampo Group

In the midst of rebuilding his life, Ramsey founded the Lampo Group, a financial counseling service aimed at helping individuals and families take control of their finances. This organization later grew into what is now known as Ramsey Solutions, a company offering a wide range of financial resources and tools.

Dave Ramsey’s Journey as a Radio Host

The Start of “The Money Game”

In 1992, Dave Ramsey joined “The Money Game”, a Nashville-based radio show, as one of three alternating hosts alongside Hal Wilson and Roy Matlock. During his time on the show, Ramsey focused on topics like bankruptcy, debt elimination, and financial recovery, sharing insights from his personal experiences.

Becoming the Sole Host

As the show progressed, both Wilson and Matlock departed, leaving Ramsey as the sole host. In 1996, the program was rebranded as “The Dave Ramsey Show” and eventually simplified to “The Ramsey Show.”

A National Platform for Financial Advice

Ramsey’s three-hour, nationally syndicated show became a platform for addressing live financial questions from callers. His advice often includes Christian principles, offering a unique perspective that resonates with a wide audience. Today, the show airs on over 500 radio stations across the U.S. and Canada and is also available as a podcast.

Television Hosting on Fox Business Network

From 2007 to 2010, Ramsey extended his reach by hosting the show on the Fox Business Network, further solidifying his reputation as a trusted financial expert.

Dave’s Financial Teachings

A Strong Stance Against Debt

Dave Ramsey is known for his firm opposition to debt, particularly credit card use. He encourages individuals to avoid credit cards entirely and instead rely on a cash-based budgeting system. His envelope method involves allocating cash to specific categories, such as groceries or entertainment, to maintain better control over spending.

The Debt Snowball Method

Ramsey advocates for the debt snowball method as a strategy to pay off debt. This approach focuses on paying off the smallest debt balances first, creating momentum and motivation as each balance is cleared. While this method does not prioritize interest rates, Ramsey believes the psychological wins are more impactful in achieving financial freedom.

Criticism of Ramsey’s Teachings

Despite his popularity, Ramsey’s financial advice has faced criticism:

- Lack of consideration for income disparities: Critics argue that his teachings may not be practical for low-income individuals or families facing financial instability.

- Limited focus on emergencies: His methods are seen as less effective for those navigating unexpected financial crises.

- Investing advice scrutiny: Ramsey’s strong emphasis on stock market investments has been questioned, as critics view it as an oversimplified strategy that overlooks diversification.

Why His Teachings Resonate

While Ramsey’s advice has flaws, his straightforward and disciplined approach appeals to many seeking clear, actionable financial solutions. His methods encourage accountability and provide hope for those overwhelmed by debt.

Timeshare Exit Team Lawsuit

The Lawsuit Against Ramsey

In June 2023, Dave Ramsey found himself at the center of a $150 million lawsuit filed by several listeners of his radio show. The lawsuit alleges that these listeners were defrauded by a company called Timeshare Exit Team, which had advertised on Ramsey’s program.

The Timeshare Exit Team Controversy

Timeshare Exit Team, which is now operating under the name Reed Hein & Associates, shut down in 2021 after reaching a $2.6 million settlement over claims of deceptive practices. The company was accused of making false promises to customers about helping them get out of timeshare contracts, but many clients reported being left with no results after paying large fees.

Ramsey’s Connection

Although Ramsey is not personally named in the deceptive practices, the lawsuit argues that his endorsement of the Timeshare Exit Team led to listeners being misled. As a result, Ramsey has faced criticism for promoting companies that later faced legal trouble.

Ramsey Solutions Controversies

Discriminatory Labor Practices

Dave Ramsey’s financial counseling company, Ramsey Solutions (formerly known as Lampo Group), has faced significant criticism over its labor practices. One of the most notable incidents occurred in 2020 when Julie Anne Stamps, an employee, came out as lesbian to her supervisor. She was reportedly told that the company’s policy prohibited her from remaining employed due to her sexual orientation.

That same year, former employee Caitlin O’Connor filed a federal lawsuit claiming she was fired for being pregnant out of wedlock. The allegations raised questions about the company’s policies and treatment of employees, prompting public backlash. In response, recordings were released showing Ramsey mocking employees over the company’s policies.

COVID-19 Safety Concerns

Ramsey Solutions also faced criticism for its handling of the COVID-19 pandemic. During the peak of the crisis, the company remained open despite employees testing positive for COVID-19. Furthermore, large gatherings continued, and safety protocols were ignored. Ramsey publicly criticized face masks and other health precautions both on his radio show and in staff meetings, which sparked outrage among many.

Firing for Safety Concerns

In 2021, a former employee filed a federal lawsuit claiming he was fired for taking basic COVID-19 safety precautions. This incident added to the growing controversy surrounding Ramsey Solutions’ approach to employee health and safety during the pandemic.

Family and Personal Life

Family

Dave Ramsey is married to Sharon Ramsey, and together they have three children: Denise, Rachel, and Daniel. All of the Ramseys’ children work for Ramsey Solutions, contributing to the family-oriented nature of the business. In 2014, Dave and Rachel co-wrote the book “Smart Money, Smart Kids”, offering financial advice for families.

The Ramsey’s Real Estate Journey

Dave and Sharon Ramsey have followed their own financial principles when it comes to real estate. In 2008, they purchased five acres of land in Franklin, Tennessee, for $1.5 million. True to Dave’s advice, they paid all cash and did not take out a mortgage.

A year later, they completed a custom-built mansion spanning 13,545 square feet. The property was located next to LeAnn Rimes, who lived in her own 13,000-square-foot mansion until she sold it in 2012 for $4.1 million.

Selling the Mansion

In February 2021, the Ramseys listed their home for sale at an asking price of $15.45 million. However, they ultimately sold it in August 2021 for $10.2 million. Shortly after, they purchased a 7,000-square-foot mansion in College Grove, Tennessee, for $3.75 million.